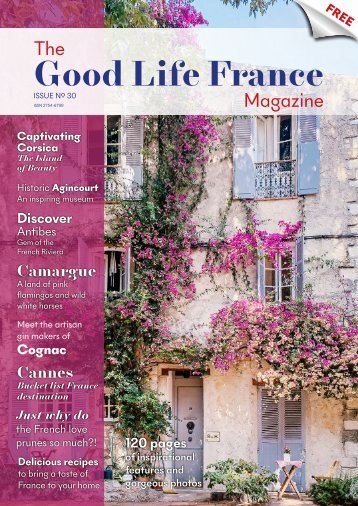

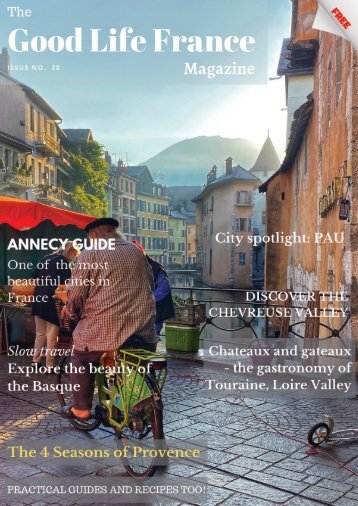

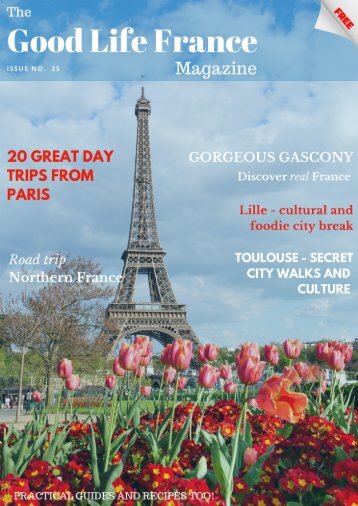

The Good Life France Magazine

The Good Life France Magazine brings you the best of France - inspirational and exclusive features, fabulous photos, mouth-watering recipes, tips, guides, ideas and much more...

Published by the award winning team at The Good Life France

Issue No. 24

Know what works best for

Know what works best for you If you have moved (or are thinking of moving) to France from the UK, then you need to know that France has a completely different tax system and completely different inheritance rules. So, to get the right advice it is essential that you talk to an International Financial Adviser who understands the rules and regulations of both the UK and France. Some people living in France are happy to keep their investments in UK deposit accounts, which make little or no interest. The low interest rates available rarely beat the inflation rate, so in real terms their investment is essentially moving backwards. Some people living in France are happy to keep their investments in UK ISA’s and Premium Bonds. Though these investments were tax-free for them in the UK, now that they’re living in France with a French tax regime, the capital gains made on these investments are taxable at 30%! And, they’re declarable every year if withdrawn or not. Making a decent return on your investment Low interest-rates mean that to make noteworthy return you may need to take a measured amount of risk within your risk profile, whilst at the same time seeking to remain as tax-efficient as possible. French tax resident is worth your time. For example, the UK pension freedom act (2015) presents you with lots of options for your pension retirement savings. You are no longer forced to purchase an annuity at historical low rates. In fact, UK annuities are currently being looked at as some companies may have potential irregularities. Your International Financial Adviser can also tell you about the best options available for your UK Pension savings as a French tax resident. Paul Flintham is an International Financial Adviser with Beacon Global Wealth Management in France Email: enquiries @ bgwealthmanagement.net Web: beaconglobalwealth.com That’s why speaking to your International Financial Adviser about the options available for your Savings and Investments as a Beacon Global Wealth Management are members of FEIFA (the) Federation of European Independent Financial Advisers: https://feifa. eu/ The information on this page is intended only as an introduction only and is not designed to offer solutions or advice. Beacon Global Wealth Management can accept no responsibility whatsoever for losses incurred by acting on the information on this page. The financial advisers trading under Beacon Wealth Management are members of Nexus Global (IFA Network). Nexus Global is a division within Blacktower Financial Management (International) Limited (BFMI). All approved individual members of Nexus Global are Appointed Representatives of BFMI. BFMI is licensed and regulated by the Gibraltar Financial Services Commission and bound by their rules under licence number FSC00805B.

- Page 3:

Editor's Letter Welcome to the Autu

- Page 6 and 7:

Features continued 48 Le Weekend: B

- Page 8 and 9:

Where to enjoy wine in winter in Fr

- Page 10 and 11:

ALSACE Alsace is the quintessential

- Page 12 and 13:

BORDEAUX Bordeaux makes for an idea

- Page 14:

BURGUNDY Burgundy’s wines are kno

- Page 18 and 19:

MOCO There are two exhibitions and

- Page 20:

Eat out Locals love: Café Joseph k

- Page 24 and 25:

The medieval town of Dinan in Cotes

- Page 26 and 27:

Head behind the Basilica of Saint-S

- Page 28:

Where to eat in Dinan Just wander t

- Page 32 and 33:

Catacombes de Paris Head 20 metres

- Page 34:

Janine marsh explores the Côtes d

- Page 37 and 38:

Ploumanac’h - Perros-Guirec Perro

- Page 39 and 40:

From Paimpol you can take a 10 minu

- Page 41:

Where to stay: Hotel Edgar in Saint

- Page 44 and 45:

Balades a Raquettes In my search fo

- Page 47: And relax at the Nama Springs Tucke

- Page 50 and 51: Historic centre Looking like someth

- Page 52 and 53: Chateau Museum The Chateau Comtal w

- Page 54 and 55: Eat out Enjoy the local favourite,

- Page 56: Strolling through the Dordogne Vall

- Page 59 and 60: The Dordogne flows 472km from Massi

- Page 62 and 63: Destination: Mulhouse

- Page 64 and 65: Mulhouse in Alsace in the northeast

- Page 66 and 67: Tour du Belvedere Not far from Mulh

- Page 68: Where to eat out in Mulhouse Café

- Page 71 and 72: In Le Havre, Perret delivered an id

- Page 73 and 74: uilt in 1859. Recently restored, it

- Page 75 and 76: New and fab: The Architect is run b

- Page 77: private provence tours Customized t

- Page 81 and 82: COLLIOURE Lonna Coleman captures th

- Page 83 and 84: Collioure is easily reachable by tr

- Page 85: july: Sunflowers in Gascony by Sue

- Page 89 and 90: Banking in France Finally, when rec

- Page 91: Register in the social security sys

- Page 95: Why it is essential to talk to your

- Page 99 and 100: DIRECTIONS: Soak the raisins overni

- Page 101 and 102: Method Melt the butter gently in a

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...