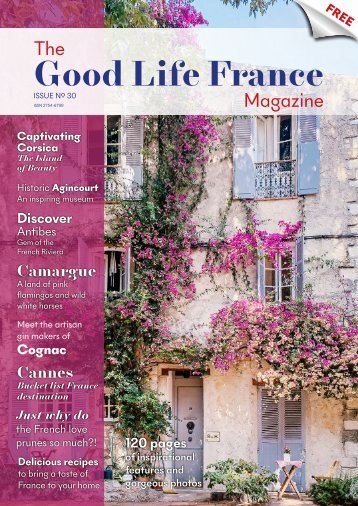

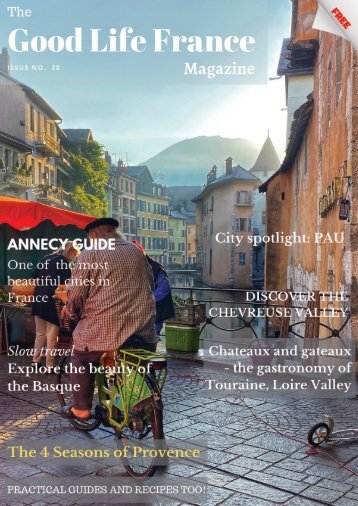

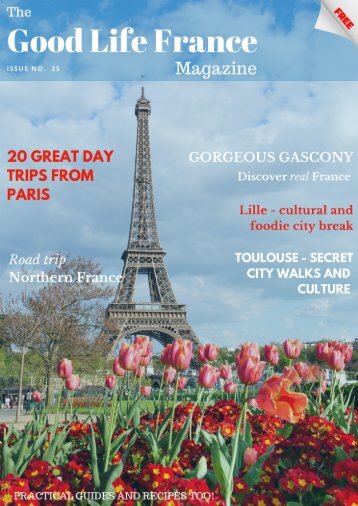

The Good Life France Magazine

The Good Life France Magazine brings you the best of France - inspirational and exclusive features, fabulous photos, mouth-watering recipes, tips, guides, ideas and much more...

Published by the award winning team at The Good Life France

Issue No. 28

Why British expats in

Why British expats in France should review their finances post Brexit Following the UK’s departure from the European Union in 2021, Jennie Poate, head of operations at Beacon Global Wealth, financial advisors for expats in France, advises on changes that may affect some people. How has Brexit affected banking and finance services for expats in France? There have been occasions where UK financial institutions have changed how they treat clients who live outside of the UK and companies. For instance some banks notifying clients that they can no longer hold accounts, and The changes brought about by Brexit mean that some companies no longer have a European licence for financial and insurance services. Essentially they are no longer able to support offshore clients. Even the big banks such as Barclays have been in the headlines for sending letters saying they will close bank accounts for non-residents. This caused causing concern and upset for many people. There are though on line bank accounts which offer multicurrency accounts which may provide a simple solution for those who are tech savvy and want to maintain a sterling account – those with pension income for example. (Ed’s note: for instance Revolut and Transferwise). Pensions post Brexit for expats in France Some Brits with pensions in the UK are having issues, for instance Aviva not allowing online access for clients. When it comes to pensions that are in drawdown or not yet in payment, a France-based advisor who is qualified to advise on both the UK and French finances can help you asses your current arrangements and compare alternatives which might hold greater flexibility. If you would like a no-obligation, free consultation, contact Jennie Poate, head of operations at Beacon Global Wealth. beaconglobalwealth.com jennie @ bgwealthmanagement.net Please be aware that Beacon Global Wealth management are not tax advisors or accountants. The information on these pages based on current regulations is intended only as an introduction only and is not designed to offer solutions or advice. Beacon Global Wealth management are not tax advisors or accountants. Beacon Global Wealth Management can accept no responsibility whatsoever for losses incurred by acting on the information on this page. The financial advisers trading under Beacon Wealth Management are members of Nexus Global (IFA Network). Nexus Global is a division within Blacktower Financial Management (International) Limited (BFMI). All approved individual members of Nexus Global are Appointed Representatives of BFMI. BFMI is licenced and regulated by the Gibraltar Financial Services Commission and bound by their rules under licence number FSC00805B

- Page 1:

Bonjour and welcome to the latest e

- Page 5 and 6:

Contents Features 8 Spotlight on: A

- Page 7 and 8:

Recipes Gastronomy 96 Travel with y

- Page 10 and 11:

‘’Now I have been happy. Now I

- Page 12 and 13:

“My god it’s beautiful” Napol

- Page 15 and 16:

Veyrier-le-Lac just 5km from Annecy

- Page 17 and 18:

Above: La Brasserie Irma Lunch: Mid

- Page 19 and 20:

Seythenex at the food of the Bauges

- Page 23 and 24:

Treats Cake my Day: Annecy is gifte

- Page 25 and 26:

Uncover the charms of slow travel i

- Page 27 and 28:

mountain, renowned for its famous E

- Page 29 and 30:

Donostia Donostia, as San Sebastian

- Page 31 and 32:

together in the bowl of a stand mix

- Page 33:

Every major city has its iconic str

- Page 36 and 37:

Today this marvel of 19th century e

- Page 38 and 39:

a Brigadier General under Napoleon

- Page 41 and 42: atmospheric property with wooden ga

- Page 43 and 44: Melissa Barndon explores the charmi

- Page 45 and 46: The castle was constructed in the 1

- Page 47 and 48: A famous legend rose up around the

- Page 49 and 50: young and old, and waiting in the c

- Page 51: garlic for around 14 months, before

- Page 54 and 55: Provence is enchanting year round.

- Page 56 and 57: SUMMER Bonnieux is one of my favour

- Page 59 and 60: WINTER Aged but timeless buildings

- Page 61 and 62: du Midi

- Page 63: The opening of the Canal du Midi On

- Page 66 and 67: King Arthur’s forest Kevin Pilley

- Page 68 and 69: © Aurelie Polvet Tourist Office Br

- Page 71 and 72: © Aurelie Polvet Tourist Office Br

- Page 73 and 74: to David Coombs who is the authorit

- Page 75: simple.” Maxine replied “Winsto

- Page 79 and 80: A true artist Even though Churchill

- Page 81 and 82: January: Stormy, misty, marvellous

- Page 83 and 84: March: Colmar in spring by Ramus.

- Page 85 and 86: joy of opening bedroom curtains in

- Page 87 and 88: further afield. The average price o

- Page 89: Annecy However, the Alps remain the

- Page 94 and 95: change. Apps are a form of software

- Page 97 and 98: Travel with your taste buds to Tour

- Page 99 and 100: Touraine speciality Black truffles

- Page 101 and 102: Touraine speciality The baker’s r

- Page 103 and 104: Touraine speciality Nougat of Tours

- Page 105 and 106: Eat at: Le chapeau Rouge Loved by t

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...